The Awakening of the Green Steel Dragon

Asia and Oceania account for more than two-thirds of global steel production. The region makes steel primarily using the most carbon-intensive methods, contributing significantly to the steel industry’s CO2 emissions. Just four countries—China, India, Japan and South Korea—account for 61% of global steel production, with Australia being the main supplier of hematite iron ore for their blast furnaces (BFs).

Many countries are still actively installing BF capacities: India plans several-fold capacity growth, while China is modernizing its BF fleet with new, cleaner facilities. Unlike Europe, these countries are not legally bound by decarbonization targets but rather have declarative plans to reduce their emissions to net-zero by 2050 in Japan, 2060 in China, and 2070 in India. Notably, India, with an average carbon intensity of 2.54 tonnes of CO2 per tonne of steel (tCO2/ts), has adopted the taxonomy that recognizes steel with emissions less than or equal to 2.2 tCO2/ts as green, which is higher than the global average intensity of carbon steel of 1.91 tCO2/ts.

So, does this mean that the Green Steel Dragon of Asia is still asleep? No, not anymore. And its awakening, once in full force, will be of truly draconian magnitude and consequences.

Consider China’s intention to increase the share of electric-arc furnaces [EAFs] to more than 20% by 2030. Currently, the share is around 10%, and although the target might be missed, new EAFs are being installed at a pace rarely seen elsewhere in the world. Add renewables, given that China produces 85% of all photovoltaic panels in the world, and we are going to see China emerging as one of the leading producers of global green steel, including for the export markets.

In the Green Steel Profile report, we examined around 40 carbon reduction projects by Chinese steelmakers, including recent installations and planned conversions. The blast furnace-basic oxygen furnace (BF/BOF) route remains the primary target for CO2 reduction, as it will dominate in China for decades. Thirteen projects are stand-alone EAFs that replace or complement existing capacity or are entirely greenfield facilities. In addition, several projects consisting of direct reduced iron (DRI) production (using hydrogen, coke oven gas, or natural gas) combined with EAFs or electric smelting furnaces (ESFs) have been implemented or are planned for the near future. An important feature of some of these projects is the technical feasibility for using low- and medium-grade iron ore.

Australia, with its 58 billion tonnes of iron ore reserves (58% hematite, 41% magnetite), is positioning itself to benefit from the global steel industry’s decarbonization. Australian authorities are banking on magnetite because it can be enriched up to 60-70% iron content and contains fewer impurities, making it a good choice for producing DRI/HBI for export or for local green steelmaking.

Australia, with its 58 billion tonnes of iron ore reserves (58% hematite, 41% magnetite), is positioning itself to benefit from the global steel industry’s decarbonization. Australian authorities are banking on magnetite because it can be enriched up to 60-70% iron content and contains fewer impurities, making it a good choice for producing DRI/HBI for export or for local green steelmaking.

Take Fortescue, one of the leading iron ore producers. In 2025, the company is piloting a combination of green hydrogen DRI and an ESF at its Christmas Creek mine in the Pilbara region of Western Australia. This pilot project is expected to produce around 1,500 tonnes of green iron per year, but the company is considering a possible expansion to 1 mtpa and is ultimately targeting production of 100 mtpa of green iron in partnership with China.

South Australia is also aiming to advance its green projects to match its western neighbour. In February 2025, the South Australian government placed Whyalla Steelworks, a BF/BOF steel producer, into administration. That same month, it announced US$1.5 billion in government funding to replace the steelworks’ existing BF/BOF operations with a 1.8 mtpa DRI plant and a 1.5 mtpa EAF facility.

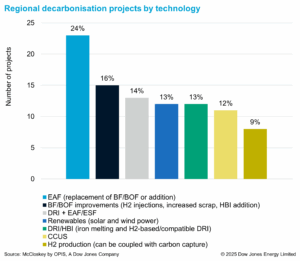

In total, we studied more than 90 decarbonization projects in Asia and Oceania, spanning across various technologies. New EAF installations are leading the way in China and Japan, along with BF/BOF optimisation and development of carbon capture, utilization and storage (CCUS) technologies. Renewables are dominating in solar-rich India, while the DRI-EAF/ESF route is emerging in Australia and South Korea.

Theoretically, one might expect the DRI-EAF/ESF/BOF combination to become the primary pathway to a green steel future in all these countries, similar to Europe or the MENA region. This makes sense as the DRI-EAF/ESF combination allows production of high-quality steel from various grades of iron ore with a minimal carbon footprint if hydrogen or a hydrogen gas mix is used to reduce iron oxides in shaft furnaces.

Theoretically, one might expect the DRI-EAF/ESF/BOF combination to become the primary pathway to a green steel future in all these countries, similar to Europe or the MENA region. This makes sense as the DRI-EAF/ESF combination allows production of high-quality steel from various grades of iron ore with a minimal carbon footprint if hydrogen or a hydrogen gas mix is used to reduce iron oxides in shaft furnaces.

However, there is a distinction. Europe, driven by its 2030 emission reduction target under the European Climate Law, and the natural gas-rich MENA region will likely use natural gas in a transition phase while awaiting affordable and accessible hydrogen. Natural gas importers like China, India, Japan, and South Korea may bypass this phase, moving directly to hydrogen, which also means a longer overall transition timeframe for them. Therefore, the Green Steel Dragon of Asia will show its full power once cost-effective hydrogen becomes available on an industrial scale.

This post features insights from the Green Steel Profile report for Asia and Oceania, published by McCloskey in June 2025. For a more insights into the green transition on a project-by-project basis, please refer to McCloskey’s Green Steel Profile report for Asia and Oceania.