Tariff Kerfuffle Clears Waterways for Canadian LPG Exports

The tariff war between the United States and other nations, most specifically China, has the potential to open greater opportunities in Canada’s burgeoning LPG export market.

Canada’s main advantage is in sailing time to Asian markets. Canadian midstream AltaGas estimates that LPG carriers from the West Coast to Japan take only about 10 to 11 days to arrive. By comparison, a journey from the Arab Gulf can be 18 or more days, while a trip from the U.S. Gulf Coast—not counting potential delays at the Panama Canal—could take 25 days or more.

“Asian end markets are seeking to diversify their propane away from the U.S. and the Middle East,” Vern Yu, president and CEO of AltaGas, said on an earnings call May 1. “This global trade uncertainty has reinforced the importance of market diversification, reiterating the need to connect Canada’s energy exports to premium global markets.”

U.S. President Trump’s back-and-forth tariff rhetoric, including threats of particularly heavy levies on China, has resulted in “pretty big shifts in global demand where obviously China is not importing much propane from the U.S.,” Yu said. Meanwhile, “demand for Canadian propane has remained very strong and very robust during this period.”

Much like the United States, Canada has undergone rapid growth in oil and gas production over the past several years due to improvements in drilling technology. AltaGas estimates Canadian NGL supplies between 2020-2030 will rise by 400,000 b/d, about 30%, to just under 1.6 million b/d.

Meanwhile, it expects demand across North America to be flat over this period, which means Canada will need another outlet for its growing production.

In a May investor presentation, AltaGas said Asia is where Canada’s LPG will be best served. It predicts that between 2022-2040, total Asian propane import demand—led by China and India—will rise by about 42% and butane by about 48%, to which Canada can contribute a share of supply.

Export Flows Shift Beyond U.S. Destinations

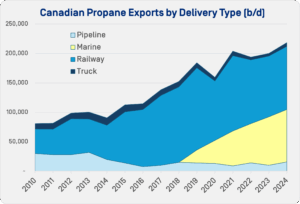

Historically, all Canadian propane exports went to the U.S. as their initial destination, shipped via pipeline, railcar or truck. However, that changed in 2017, when the Canada Energy Regulator reported that 5,305 b/d, or 3.8% of annual exports of 138,225 b/d, was shipped outside the U.S.

This percentage has grown sharply through 2024, when 92,252 b/d, or 42.3% of Canada’s 218,344 b/d of outbound propane, headed to “non-USA” destinations, CER data showed.

The CER data doesn’t break out specific countries, but Canada’s first waterborne export terminal – AltaGas’s Ridley Island Propane Export Terminal (RIPET), jointly owned with Royal Vopak and commissioned in 2019 — was designed with Asian propane consumers specifically in mind.

The CER data doesn’t break out specific countries, but Canada’s first waterborne export terminal – AltaGas’s Ridley Island Propane Export Terminal (RIPET), jointly owned with Royal Vopak and commissioned in 2019 — was designed with Asian propane consumers specifically in mind.

AltaGas is easily the most prolific waterborne exporter of LPG on the West Coast of Canada and the United States. RIPET, located near Prince Rupert, B.C., currently has aggregate propane export capacity of 92,000 b/d.

In December 2020, the company also assumed ownership of the Ferndale terminal in Washington state. It is designed to accommodate up to 50,000 b/d of propane and butane exports from Pacific Northwest refining operations.

Currently, the only other LPG export terminal on the West Coast of Canada or the United States is Pembina’s facility on Watson Island, located near Prince Rupert, B.C. This terminal is more limited in its operations, with an outbound capacity of around 25,000 b/d of propane.

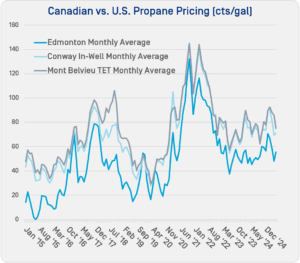

Canadian propane at Edmonton, Alberta, tends to trade at differentials—most commonly discounts—to Conway in the U.S. Midwest. OPIS price data shows Edmonton’s discount to Conway has steadily averaged between 10 and 30cts/gal since mid-2020, even as waterborne exports have ramped up.

AltaGas’s own pricing formula out of RIPET is based on Asian LPG pricing, less all-in costs (export tolls, rail, operational expenses and shipping). The company estimated that, over the past two years, the netback of shipping LPG to Asia was $6/bbl (about 14.3cts/gal) stronger than if it sent it south to Conway.

AltaGas’s own pricing formula out of RIPET is based on Asian LPG pricing, less all-in costs (export tolls, rail, operational expenses and shipping). The company estimated that, over the past two years, the netback of shipping LPG to Asia was $6/bbl (about 14.3cts/gal) stronger than if it sent it south to Conway.

Room to Grow Beyond 2027

Future Canadian LPG export expansion plans currently extend as far out as 2027.

AltaGas’s Ridley Island Energy Export Facility (REEF) is currently under construction. Located adjacent to RIPET, REEF would have a design capacity of 55,000 b/d of LPG. It is expected to come online by year-end 2026.

At its existing RIPET terminal, AltaGas will move forward on a methanol removal project. While this would not boost export capacity, it would improve quality specifications so that it can export its propane to all Asian markets via either RIPET or REEF. The project is planned to be online by the end of 2026.

Part of Pembina’s 2025 capital program includes evaluating optimization of its Prince Rupert terminal to allow larger vessels to load, though it gave no further details in a May investor presentation.

Finally, Trigon Pacific Terminals has proposed to repurpose a thermal coal export terminal on Ridley Island to export 2.5 million mt/yr of LPG to what its CEO described as “eager, un-tariffed Asia-Pacific buyers” by 2029. The company announced a final investment decision on the project on June 11.

However, the fate of this project is uncertain—the Prince Rupert Port Authority maintains AltaGas and Vopak have exclusive rights to export LPG out of the port. Trigon sued the port authority in November 2023, believing this to be in breach of its lease terms, and the matter is still before the courts.