Tariff Imposition Distorts U.S.-Asia LPG Trade While India Forms New Alliances

The U.S.-China trade war has played its part in reshaping Asia’s liquefied petroleum gas (LPG) market, distorting traditional trade flows and affirming new patterns.

Traditionally, China mainly relies on U.S. propane imports to supply its growing propane dehydrogenation (PDH) sector. According to customs data, the country imported 35.408 million metric tons of LPG in 2024, with U.S. origin cargoes accounting for more than half of total imports at 17.982 million mt.

However, the U.S.-China trade war, marked by an escalation in April with reciprocal tariffs of over 100%, has thrown Asia’s LPG market into a state of uncertainty. Traditional regional trade flows have been altered, leaving other major producers like those in the Middle East to contend with supply and demand challenges.

Shifts in Asia’s LPG trade flows

Following China’s initial announcement of retaliatory tariffs on April 4, 2025, the OPIS CFR Japan flat price—the reference price for Asian LPG—fell by $67.75/mt on day amid bearish sentiments driven by an anticipated decline in Chinese demand, closing at $521/mt the following session. The flat price for April averaged $523/mt, a sharp decrease from pre-tariff levels that had exceeded $600/mt.

Similarly, the OPIS Mont Belvieu Delivered (OMBD) Japan — the cost of U.S.-origin propane delivered to Asia—declined by $30.27/mt on day to close at $526.25/mt after the announcement. While the price of U.S.-origin LPG dropped, Middle East cargoes remained stable, leading to a widening price spread between U.S. and Middle East cargoes.

This prompted a shift in trade routes, with Chinese PDH operators turning to Middle East propane supply as an alternative to U.S. LPG cargoes, which became more expensive due to steep tariffs.

Other import markets in Asia, including South Korea, Japan and Southeast Asia, capitalized on the falling prices to secure U.S. cargoes, spurring a brief buying spree in April. OPIS tracked 13 buy tenders from non-Chinese importers in April, while Chinese importers issued 10 buy tenders seeking Middle Eastern cargoes, fearing a future price spike in anticipation of stronger demand from China.

Other import markets in Asia, including South Korea, Japan and Southeast Asia, capitalized on the falling prices to secure U.S. cargoes, spurring a brief buying spree in April. OPIS tracked 13 buy tenders from non-Chinese importers in April, while Chinese importers issued 10 buy tenders seeking Middle Eastern cargoes, fearing a future price spike in anticipation of stronger demand from China.

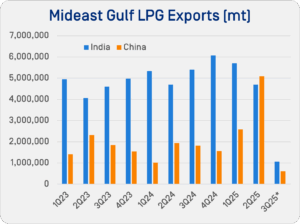

Atypically, China was the largest recipient of Middle East Gulf supply in the second quarter of 2025, a direct result of the tariff imposition. India held this title since Q2 2018, Vortexa data shows.

Despite the 90-day temporary tariff pause announced by the world’s two largest economies on May 12, 2025, traditional trade flows have not been restored. Chinese importers continued to source from the Middle East, driven by fears that trade tensions might escalate again.

Between April and June, China received a total of 5.09 million mt of LPG from the Middle East Gulf, up from 2.58 million mt in January to March and 1.94 million mt a year earlier. Meanwhile, exports from the Middle East Gulf to India dipped to 4.64 million mt in Q2, down from 5.7 million mt in January to March and 4.69 million mt a year earlier.

Iran replaced the U.S. as China’s top LPG exporter in June, accounting for 667,400 mt of China’s total 2.61 million mt imports, while U.S. LPG cargo exports to China plummeted from 1.5 million mt in April to just 291,200 mt by June.

U.S.-India Alliance Emerges

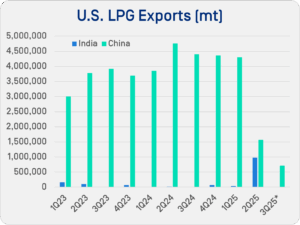

With China sourcing more LPG volumes from the Middle East Gulf, India has turned to the U.S. to help meet its growing demand.

With China sourcing more LPG volumes from the Middle East Gulf, India has turned to the U.S. to help meet its growing demand.

The U.S. exported 967,000 mt of LPG to India in Q2 2025, more than treble the previous quarterly record of 318,000 mt in Q1 2020.

India’s LPG imports for residential consumption are predominantly evenly split cargoes. The country accounted for 46.1% of the Middle East’s total LPG exports last year.

At the same time, India’s demand for product is rising. According to government data, the total number of active domestic LPG consumers in India as of March 1 stood at 329,400,000, including 103,000,000 beneficiaries of the Pradhan Mantri Ujjwala Yojana (PMUY) subsidy scheme.

Launched in 2016, the subsidy scheme aims to help rural and deprived households transition from traditional cooking fuels such as firewood, coal and cow-dung cakes.

In 2021, the government launched the Ujjwala 2.0 scheme to help further the reach of the earlier scheme and exceed its annual targets.

Middle East Propane and Butane Supply Imbalance

While Middle Eastern LPG cargoes have been mostly evenly split propane-butane cargoes tailored to India’s residential usage, China’s steady purchases of propane from the region have resulted in a butane oversupply, with limited avenues for clearing the surplus left in the region. The only viable outlet for this excess is other Asian crackers that consume butane, but most other Asian importers favor cheaper U.S. butane cargoes.

As a result, the propane-butane spread has widened. OPIS reported that the average spread for CP swaps widened from an average of $12/mt in March to $20/mt in April, rising further to $26/mt in May and $28/mt in June, indicative of propane’s increasing premium.

However, the spread has been narrowing since July, amid a slowdown in Chinese demand following President Trump’s announcement of an Aug. 12, 2025, tariff negotiation deadline, by which China has to reach an agreement with the U.S. or face the reimposition of earlier tariffs. This has deterred many Chinese importers from making spot purchases and helped to rebalance Middle Eastern supply.

Conflict Fragments the East of Suez VLGC Sector

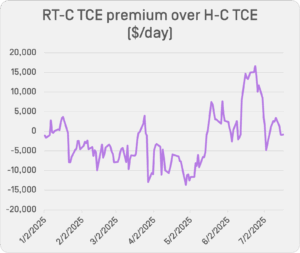

The rapid rise in tensions between Israel and Iran on June 13 sent freight and LPG prices climbing, specifically the Ras Tanura-Chiba Very Large Gas Carrier (VLGC) assessment.

The conflict also caused greater fragmentation with multi-tiered VLGC markets even appearing within the Mideast Gulf as well as on other-linked routes.

With the number of shipowners willing to fix ships from the Mideast Gulf declining to avoid the Strait of Hormuz, owners willing to lift cargoes from key export hubs in Saudi Arabia, Qatar, United Arab Emirates and Iran were asking for firm premiums. In some cases, Mideast Gulf loadings were commanding a premium of around $10-15/mt more on freight than other supply points linked to the Mideast Gulf — such as the U.S. West Coast, West Africa and Northern Australia, or even Yanbu on Saudi Arabia’s west coast.

With the number of shipowners willing to fix ships from the Mideast Gulf declining to avoid the Strait of Hormuz, owners willing to lift cargoes from key export hubs in Saudi Arabia, Qatar, United Arab Emirates and Iran were asking for firm premiums. In some cases, Mideast Gulf loadings were commanding a premium of around $10-15/mt more on freight than other supply points linked to the Mideast Gulf — such as the U.S. West Coast, West Africa and Northern Australia, or even Yanbu on Saudi Arabia’s west coast.

On a time charter equivalent (TCE) basis, the OPIS assessed Ras Tanura-Chiba VLGC rate opened up a significant premium over the Houston-Chiba VLGC TCE. The East of Suez TCE premium over the West peaked on June 24 at $16,500/day from a discount of around $2,500/day to the West in May and $8,000/day in April.

However, this fragmentation has eased following the ceasefire between Iran and Israel in late June, and the Ras Tanura-Chiba VLGC rate holds a small premium over the West of Suez option.

Continued Uncertainty in Asia’s LPG Market

The Asian market continues to face uncertainty as to whether traditional trade flows will be restored. All eyes are now fixed on the Aug. 12 deadline on the tariff pause, which will be a critical determinant of whether China regains access to U.S. LPG supply. Until this deadline, Chinese importers are expected to remain on the sidelines awaiting greater clarity, which will help rebalance propane and butane supply in the Middle East. However, this also comes amid poor demand not just from China but also India as it enters the monsoon season, which typically leads to a drop in LPG consumption.