Will Gasoline Demand Recover This Summer Driving Season?

Memorial Day weekend is in the rearview mirror, and that means the summer driving season has officially begun. Where retail gasoline prices currently stand, there is a chance that this could be a strong season from a demand standpoint.

This year’s Memorial Day weekend brought with it the lowest national average retail gasoline prices since Memorial Day 2021, when the U.S. was still coming out of the COVID pandemic. Low retail gasoline prices in 2025 have the potential to be a solid support point for a recovery in gasoline demand.

What may also help gasoline demand this summer is air travel. Air travel these days is anything but glamorous, and it is also getting quite pricey. Airlines have also removed their financial guidance for the year, as reduced international travel may create the need to boost revenue through domestic sales to replace lost international travelers.

Memorial Day weekend got off to a strong start based on the Energy Information Administration’s estimate of gasoline demand. Leading into the long holiday weekend, U.S. gasoline demand averaged 9.542 million b/d. That was the highest weekly estimate so far this year. That is not surprising considering 2025 has been littered with mostly pedestrian demand weeks up to that point.

OPIS demand data also pointed to a strong holiday weekend, with same-store sales rising nearly 2% from the previous week ahead of the holiday weekend.

There are a few tendencies gleaned from the OPIS demand data, which is gathered from roughly 35,000 stations throughout the country. An analysis of the past four years of summer demand data reveals Memorial Day weekend is about as good as it gets from a volume standpoint, posting the highest weekly average volume of the year.

There was one lone exception over the past four years—the week ending July 1, 2023, was the peak week for volumes that summer and year. In 2021, 2022 and 2024, OPIS data reveal that peak volumes take place from May 14 through May 25. While 2023 did not reach the highest station volume week until much closer to the Fourth of July, the second highest week was the week ending May 20, the week leading into the Memorial Day weekend.

There was one lone exception over the past four years—the week ending July 1, 2023, was the peak week for volumes that summer and year. In 2021, 2022 and 2024, OPIS data reveal that peak volumes take place from May 14 through May 25. While 2023 did not reach the highest station volume week until much closer to the Fourth of July, the second highest week was the week ending May 20, the week leading into the Memorial Day weekend.

EIA demand data conversely leans toward the July 4 holiday weekend being the strongest week of the year. Generally, the EIA data points to strong demand for the Memorial Day weekend. But it is typically the Fourth of July weekend that has consistently strong demand estimates.

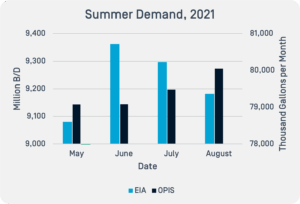

However, 2021 may ultimately serve as the standard for gasoline demand in a post-COVID demand environment. During that summer, EIA consistently posted demand above 9 million b/d for three months, spanning the week of June 10 through the week of September 10.

However, 2021 may ultimately serve as the standard for gasoline demand in a post-COVID demand environment. During that summer, EIA consistently posted demand above 9 million b/d for three months, spanning the week of June 10 through the week of September 10.

There were a few outliers in the EIA data over the past four years. In 2022 and 2024, the strongest weekly estimates came either in the late third or early fourth quarter of the year.

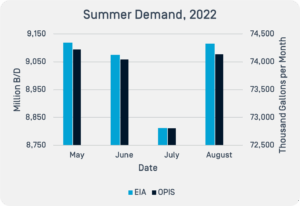

2022 has a pretty simple explanation. June and July 2022 had the highest monthly retail gasoline averages on record at $4.92/gal and $4.55/gal, according to AAA. This was in response to triple-digit crude oil prices stemming from the Russian invasion of Ukraine in February of that year and the subsequent sanctions from the West on Russia. Those sanctions had created market worries over the loss of Russian barrels.

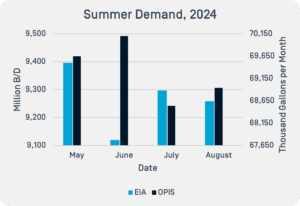

Meanwhile, last year, gasoline prices near Memorial Day were coming off the highs for the year, perhaps leading to some caution amongst U.S. motorists. The highest averages in 2024 were in mid-to-late April at a little more than $3.66/gal. Prices were on a downswing by Memorial Day. The 2024 high-demand period in the late third to early fourth quarter coincided with national averages falling below the $3.20/gal mark.

Meanwhile, last year, gasoline prices near Memorial Day were coming off the highs for the year, perhaps leading to some caution amongst U.S. motorists. The highest averages in 2024 were in mid-to-late April at a little more than $3.66/gal. Prices were on a downswing by Memorial Day. The 2024 high-demand period in the late third to early fourth quarter coincided with national averages falling below the $3.20/gal mark.

There is usually a strong belief that demand goes down when the price goes up. But in most cases, that proves to not be the case, particularly in the summer months. A study of weekly demand data from the EIA and the weekly retail average price data from AAA reveals no inverse correlation between the two.

Basically, if people want to drive during the summer months, they will. That does not mean there is not a threshold at which drivers change their behaviors. There is some evidence that there is a price threshold at which drivers will reduce their activity in the summer months if prices get too high.

Thanks to record-high prices, a behavioral change took place in 2022. June 2022 saw the highest-ever national monthly average gasoline price at $4.921/gal. June demand averaged 9.075 million b/d, according to EIA, while OPIS pointed to a monthly average gallons sold of 74,045. June demand was down from the previous month in both the EIA and OPIS monthly data, though the declines were within 0.5%.

Thanks to record-high prices, a behavioral change took place in 2022. June 2022 saw the highest-ever national monthly average gasoline price at $4.921/gal. June demand averaged 9.075 million b/d, according to EIA, while OPIS pointed to a monthly average gallons sold of 74,045. June demand was down from the previous month in both the EIA and OPIS monthly data, though the declines were within 0.5%.

There was a more noticeable decrease from June to July, even though the average retail price did drop to $4.548/gal. EIA July monthly product supplied was down nearly 3% from June, and OPIS saw a drop in station volumes of about 1.7% in July from June.

Based on the moves seen in the early months of the summer driving season, it should be no surprise that when prices dropped by 13% to an average of $3.972/gal in August, demand bounced back. EIA demand averaged 9.115 million b/d, and OPIS average gallons sold jumped to 74,137 gallons—increases of 3.44% and 1.83%, respectively.

There does appear to be a threshold where demand sees meaningful impacts, which is likely in the $4.75-5/gal area.

Current prices are unlikely to deter drivers this summer and are unlikely to reach levels that could impact them.

Heading into June, the national average price, according to AAA, was about $3.15/gal. Throughout the year, the average has not spent much time above even the $3.20/gal level.

Though gasoline prices are not expected to spike significantly this summer, there are a few potential pitfalls to be aware of as the warmer and longer days arrive.

According to the latest EIA data, through May 23, US gasoline inventories were 5.8 million bbl below the 2024 level at this time of year. While that is not necessarily an insurmountable deficit and current storage levels are considered comfortable, current and last-year inventories are trending in opposite directions. Additionally, the current storage picture sees total gasoline in storage tanks 7.2 million bbl below the five-year average. All five PADDs are also at a deficit to the five-year average.

Another potential pitfall is weather and its impact on refineries. The Atlantic Basin hurricane season has gotten underway. While any significant activity does not usually arrive until later in the summer, the National Hurricane Center, as of June 2, was already tracking some weather disturbances in the Southeast. Predictions for the summer of 2025 are once again for an active hurricane season.

While several major hurricanes have hit the United States over the past couple of years, they have largely spared any refining infrastructure.

Although hurricanes get the most attention from a weather standpoint, heat waves can also negatively affect refinery operations. In the last decade, a long string of hot weather has inspired refinery downtime, which could tighten supply and push prices higher.

Overall, a low price environment for retail gasoline prices this summer should lead to one of the better summers of demand in a post-COVID environment.