Making the Americas Green: Decarbonization in Regional Steelmaking

Featuring insights from the Americas Green Steel Profile report, published by McCloskey on July 31, 2025.

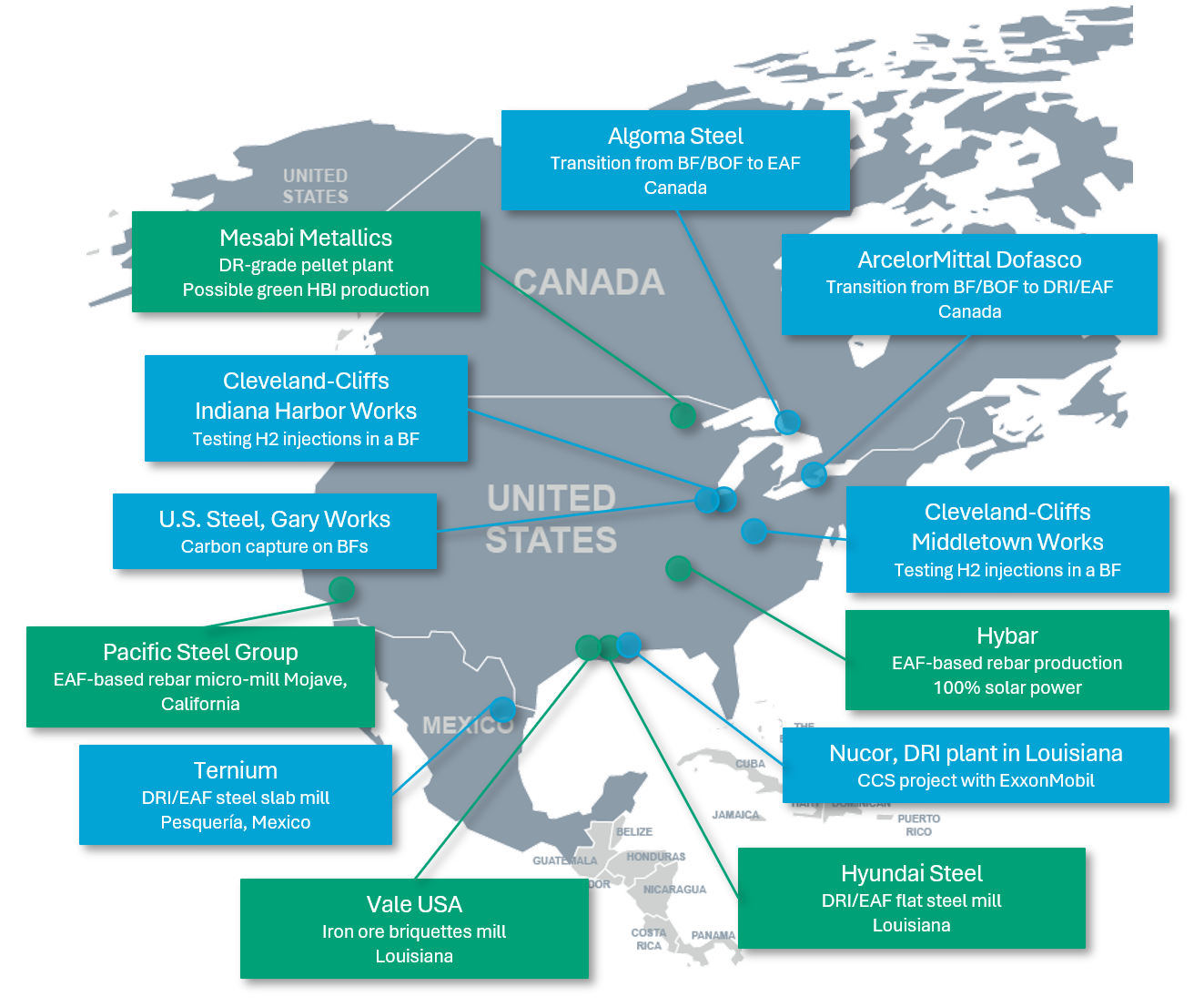

The North and South American steel industry reflects a diverse array of decarbonization trends, as the countries have different macroeconomic environment, dominant steelmaking technologies, and national priorities.

The United States, the largest steel producer in the Western Hemisphere, makes nearly 72% of its steel in electric arc furnaces (EAFs). This steel already has a relatively low carbon intensity, and with the use of fossil-free electricity (as in the case of U.S. Steel’s Big River Steel mills) embedded CO2 emissions are close to zero.

The U.S. steel market is well protected from imports after President Donald Trump doubled Section 232 steel tariffs to 50% in June 2025. With the return of the fossil-fuel-focused “drill, baby, drill” philosophy, the environment is not encouraging to invest in decarbonization. For example, Cleveland-Cliffs announced in June that it was abandoning plans to transition from blast furnace/basic oxygen furnace (BF/BOF) to direct reduced iron/EAF (DRI/EAF) steel production at its Middletown, Ohio, plant, citing the US government’s changing energy priorities.

Does this mean that the U.S. steel industry is going against the global decarbonization trend? Not at all.

The very same Cleveland-Cliffs is testing hydrogen injections into BFs at its Ohio and Indiana plants. Nucor, the largest U.S. steelmaker by volume and a 100% EAF-based producer, plans to reduce its greenhouse gas (GHG) emissions further through various approaches, including carbon capture and storage, renewable energy, and nuclear power. U.S. Steel may continue the shift to electric steelmaking, eventually adopting DRI/HBI production running on natural gas and possibly on hydrogen in the future. Alabama-based ArcelorMittal Calvert has just commissioned a new 1.5 mtpa EAF and a slab caster. And the list continues to grow.

As the U.S. market has become a prime destination for new steelmaking capacity, several Asian players have announced the construction of new plants in the U.S. that will rely on greener technologies. Specifically, Nippon Steel, the new owner of U.S. Steel, discussed plans to invest $11 billion to expand and modernize U.S. Steel’s capacity, including the construction of a new steel mill. Korea’s Hyundai Steel will invest $5.8 billion in a new 2.7 mtpa DRI/EAF flat steel production in Louisiana.

Canada’s steel sector, despite the strain of the U.S. tariffs, is nonetheless slowly shifting from BF/BOF to EAF steelmaking. Algoma Steel launched a new EAF in July, one of two that are expected to replace its BF/BOF operations. ArcelorMittal Dofasco, that operates both BF/BOF and EAF, was also considering transition to DRI/EAF technology.

South America is a different story. More than 80% of the continent’s steel is produced in Brazil, of which over 75% comes from BF/BOF operations. The U.S. once consumed the bulk of Brazil’s exports, mainly semi-finished steel; however, the impact of tariffs is likely to reshape these flows.

South America is a different story. More than 80% of the continent’s steel is produced in Brazil, of which over 75% comes from BF/BOF operations. The U.S. once consumed the bulk of Brazil’s exports, mainly semi-finished steel; however, the impact of tariffs is likely to reshape these flows.

But the most important factor to consider is that Brazil is the world’s second-largest producer and exporter of iron ore, after Australia. The strategy is therefore similar: to create production of green iron to supply steelmakers around the world. Take Brazilian Vale, for example, which is focusing on finding partners to develop so-called mega-hubs. The goal is to create low-carbon DRI/HBI production in regions with access to iron ore resources, sustainable energy (wind or solar), and logistics, particularly in Brazil. Vale, in collaboration with its partners, is developing renewable energy projects and green hydrogen production sites to support these future mega-hubs, and is promoting its innovative product, iron ore briquettes, intended for the production of green DRI/HBI.

ArcelorMittal Brasil, which operates BF/BOF flat mills and EAF long mills in eight Brazilian states, is also focusing on the development of wind and solar farms in Brazil and in Argentina, planning to cover a substantial portion of its energy needs with renewables in the near future.

An interesting factor shaping decarbonization of the Brazilian steel sector is that the country is the world’s largest producer of charcoal. Local steelmakers use it in BFs as a reducing agent instead of coke to produce green steel, as the carbon emissions from the process can be offset, because the released CO2 is considered absorbed by the trees that these steelmakers are planting on a large scale.

As things continue to evolve, we are making analytical snapshots of decarbonization trends and company initiatives in the McCloskey’s Americas Green Steel Profile report. We will update the report by comparing the initial and updated plans, providing insights into how the regional industry is going green. Learn more about McCloskey and our coal, metals & mining industry pricing and news.