Exclusive: EC Steel Draft to Slash Quotas, Hike Tariffs

The European Commission’s draft proposal to replace the bloc’s steel safeguard system seeks to revolutionize existing temporary protections into a new permanent law, according to internal Commission documentation seen by McCloskey.

The proposals include significant restrictions to quota volumes, a 50% out-of-quota tariff on steel imports, and the introduction of a “melted and poured” mechanism.

Commission drafts call for a Recommendation for a Council Decision, as well as a Proposal for a Regulation of the European Parliament and Council, which will outline the EC’s intentions for a long-term steel protection mechanism. The documents are deemed “sensitive”—to be distributed on a “need to know” basis only—and when read together illustrate the European Commission’s plan to conduct a large-scale rework of its current steel safeguard, without falling foul of the bloc’s commitment to World Trade Organization (WTO) rules.

The Commission is recommending three key changes:

- Significant restrictions to steel import accessibility, aiming to approximately halve total quota volumes to reduce import market share to a 13%. and removing elements such as the carrying-over of unused quota

- A doubling of the existing out-of-quota tariff rate to 50% ad valorem

- The introduction of a “melted and poured” principle, including obligations on importers to prove the origin of their steel

It is important to note that the draft proposal is exactly that—a draft—and could be subject to changes prior to unveiling of the official proposal (indicated to occur in the near-term) as happened with the European Steel and Metals Action Plan (SMAP) as reported by McCloskey in March.

The WTO Framework, and Turning The Safeguard Upside Down

The EU’s primary existing steel protections take the form of a safeguard system, which under the WTO framework essentially allows the bloc to impose additional tariffs to its base tariff rate on its imports in certain circumstances.

Safeguard tariffs can only be applied when when the volume of the relevant imports have increased and when an increase in imports is causing, or threatens to cause serious injury to domestic industry. These protective safeguard measures must be introduced on a temporary basis, and cannot exceed a total lifecycle of eight years.

Having identified these issues resulting from overcapacity-related trade displacement after US President Trump introduced section 232 tariffs on US steel imports during his first term, the European Commission established the current steel safeguard system in 2018 – introducing country-specific and residual tariff-rate quotas (TRQs) for specific countries in line with the EU’s historic supply chains and trade flows, imposed on top of the bloc’s base rate for steel imports, which is generally 0% or “free” for primary steel.

The safeguard must expire at the end of June 2026, when it hits its eight-year deadline.

However, as identified in the Steel and Metals Action Plan (SMAP) back in March, the threat or reality of injury to the EU’s steel industry has certainly not been remedied over the course of the last eight years as overcapacity and trade displacement effects have compounded, and much industry campaigning has been premised on the idea that the protections have been insufficient in both facilitating the investment case for the decarbonization of European steelmaking, and its fundamental competitiveness and survival.

These arguments resulted in tighter safeguards in the first quarter, and the Commission’s commitment under SMAP to formulate a long-term replacement for its steel protections before the end of the year.

The draft proposal appears to turn current protections on their head in an attempt to preserve EU adherence to WTO rules whilst allowing long-term, or even permanent steel tariffs to exceed the eight-year maximum term.

Rather than applying a 25% out-of-quota duty in addition to a 0% or minimal base rate; the base rate will effectively hike to 50%, unless imported duty-free under the relevant quota.

This would be a dramatic change: one requiring the Commission to seek European Council authorization to open consultations with other WTO members to negotiate this proposed modification to its “import tariff concessions” to 50% for steel products. Such changes would typically oblige the EU to offer said members equivalent compensation, such as the lowering of other tariff barriers to maintain trade equities.

The Recommendation for a Council Decision represents these efforts in the Commission’s draft documentation and its provisions interpret both the negotiation of tariff-rate reductions on other products and potential retaliation from other WTO members should negotiations fail, as compatible with existing EU law.

Resetting the European Steel Market Under a New Protection Framework

The Commission’s other draft document proposes a new EU law to set the 50% rate, which would require agreement from both the European Parliament, and Council.

The draft is only partially complete and lacks annexes detailing country-specific quota levels, and the specific categorisation of steel CN codes into product groups, but what provisions are present in the draft describe significant cuts to EU steel import volumes.

Global steel overcapacity plays a central role, not only as a primary factor facilitating the import-related injury to the EU’s domestic steel industry, but also in troubled trade negotiations with the US. It is therefore, unsurprising that the European Commission is looking to reset the import market to a time before overcapacity was such an issue.

The Commission sees 2013 volumes as a suitable benchmark, when imported steel accounted for 13% of the EU market. Based on consumption in 2024, the most contemporary annual reference, the EC is proposing total import quota volume of 18.35 mt.

This total quota volume would be distributed across steel product categories proportional to 2022-2024 imports, though the annex detailing product categories, and any potential changes to CN code groupings are not included in the draft.

McCloskey’s initial calculations comparing existing steel quota volumes to the Commission’s proposals indicate an overall reduction of around 45%. Based on import data reported by Eurofer for 2022-2024 volumes, actual volumes could be cut by 30%.

Predicting quota country-specific allocations is harder. The Commission mentions a number of factors that could determine a nation’s quota. According to the Commission, these include “existing and future free trade agreements,” agreements “addressing the levels of global overcapacities,” and historic allocations.

Notably, the Commission includes references to the WTO negotiations in order to enact permanent protective measures compatible with multi-lateral trade agreements, which could encourage third countries to support the changes.

“Melted and poured,” and other Technical Changes

Perhaps the part of the proposal that could have the largest effect on global steel trade flows, if effectively implemented, is a provisions for a “melted and poured” clause. This essentially links the origin of imports and therefore what quota it falls under, to the nation where the steel was originally produced.

The initial draft of SMAP included implementing an immediate “melted and poured” clause, but this was toned down to a priority consideration in the final version.

Under the new draft proposals the origin of steel is defined as “the original location in which raw steel and iron is initially produced in liquid form within a steelmaking or iron making furnace and subsequently cast into its primary solid state.”

According to the Commission, “this primary solid state may encompass either a semifinished product, including but not limited to slabs, billets, or ingots, or a finished steel mill product.”

The draft proposals include new, but as yet, undetailed, provisions obligating importers to “provide appropriate evidence” at the “moment of importation.” The Commission offers the example of mill certificates as possible evidence.

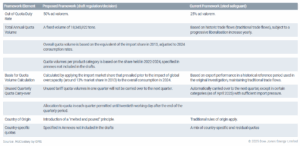

Among the more technical changes—summarized in the below table—the draft proposal removes any carry-over mechanism for unused quota volumes quarter-to-quarter, but does introduce a twenty-working day grace period for allocating import volumes to the quotas in the previous quarter.

Comparison of Proposed and Existing EU Steel Import Measures

–Reporting by Benjamin Steven, bsteven@opisnet.com, and Maria Tanatar, mtanatar@opisnet.com