May was Spectacular for Margins, but Volume Concerns Remain

May can be a Jekyll and Hyde type of month when it comes to gross rack-to-retail margins, but the 2024 rendition is certainly the version that downstream marketers would like to see on a regular basis.

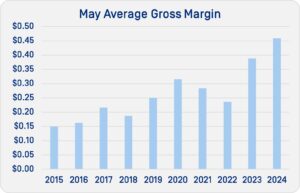

Based on the latest OPIS data, the average gross margin for the month of May came in at 45.9 cents per gallon. The May average margin was the strongest one-month average since November 2023 and it was easily the strongest May on record, as no other May has come close. Over the past 10 years (including 2024) the average margin for May was around 26.5 cents per gallon.

Based on the latest OPIS data, the average gross margin for the month of May came in at 45.9 cents per gallon. The May average margin was the strongest one-month average since November 2023 and it was easily the strongest May on record, as no other May has come close. Over the past 10 years (including 2024) the average margin for May was around 26.5 cents per gallon.

Although June is just getting started, the early returns for margins show a similar trajectory for this month, though that can change quickly, considering the volatility in markets.

The month of May certainly experienced some volatility in the average gross margin, but it was from a higher level. During the month, the daily U.S. gross margin averaged anywhere from a low of 33.4 cents per gallon at mid-month, and the high of 53.8 cents came on the last day of May.

Gasoline futures markets, as well as several spot markets, made the strong margins somewhat easy to predict.

Gasoline futures markets, as well as several spot markets, made the strong margins somewhat easy to predict.

The highest gasoline futures settlement of May was on the 2nd at $2.5965 per gallon, but by May 30th the futures market had tumbled by more than 19 cents per gallon, settling at $2.4046 per gallon.

Futures markets only tell part of the story that contributed to a strong gross margin environment as spot prices in several markets exceeded the decline seen on the paper side.

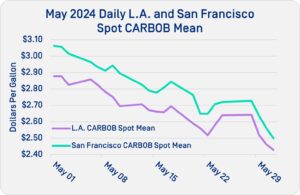

At the beginning of May, Los Angeles CARBOB was pricing around $2.825 per gallon, with San Francisco at $3.015 per gallon, OPIS spot market data shows. But by the end of the month, L.A. gasoline was almost 40 cents cheaper at $2.4275 per gallon with San Francisco more than 50 cents cheaper ending the month at $2.4975 per gallon.

At the beginning of May, Los Angeles CARBOB was pricing around $2.825 per gallon, with San Francisco at $3.015 per gallon, OPIS spot market data shows. But by the end of the month, L.A. gasoline was almost 40 cents cheaper at $2.4275 per gallon with San Francisco more than 50 cents cheaper ending the month at $2.4975 per gallon.

That move, as you may have guessed, supercharged margins throughout the month. The California average gross margin started May at 73.2 cents but ended just shy of 92 cents, with the average gross margin about 6 cents below the highs at 86.2 cents.

A strong margin environment is necessary to make up for lost gallons as same-store sales are down compared to the previous year, based on OPIS monthly gasoline demand data.

With the summer driving season officially underway, retailers will be looking for some positives, and there are some if you happen to be a “glass half full” person.

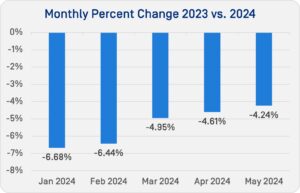

2024 started the year with very soft gasoline demand, with January running almost 7% below January 2023. However, January is typically the softest month of the year when it comes to gasoline consumption. Since January, the deficits to 2023 have been narrowing.

Though month-to-month volumes are getting some traction, same-store sales versus 2023 are still looking soft. Final May gasoline demand was about 4.2% below May 2023, but if you are looking for the positive, the year-on-year trend is narrowing as the month of May saw the smallest loss in volume compared to a year ago. In fact, May was the smallest year-on-year loss since August 2023.

Though month-to-month volumes are getting some traction, same-store sales versus 2023 are still looking soft. Final May gasoline demand was about 4.2% below May 2023, but if you are looking for the positive, the year-on-year trend is narrowing as the month of May saw the smallest loss in volume compared to a year ago. In fact, May was the smallest year-on-year loss since August 2023.

The monthly improvements are seen in most individual regions.

The heavily populated Northeast region has been consistent in its declines versus 2023 over the past three months with year-on-year declines in the 4.6-4.8% range versus 2023. While the Northeast sees the steady demand drops versus a year ago, the Mid-Continent sees a bit wider same-store sales losses on either side of 5% down.

Southwest is turning in the strongest demand with May running just 2.4% behind 2023. Other than in January when weather was poor, Southwest gasoline demand saw the largest demand destruction, but over the past 12 months, the Southwest has been in striking distance of year-ago levels.

While most point to sliding gasoline demand on the West Coast, the Pacific Coast region performed admirably in May falling 4.2% versus last year.

Based on the latest OPIS data, on a year-to-date basis same store sales are down by 5.3%. Individual regions range anywhere from down 3% to down just over 6%.

Year-on-year market share in May 2024 saw mostly minor shifts between branded and unbranded stations with unbranded stations in the U.S. grabbing a bit more market share against the branded outlets and perhaps to a lesser extent some of the big box retailers thanks to relatively calm retail gasoline prices.

During May 2024, unbranded stations in the U.S. garnered 56.09% of the market, compared with 55.58% during the same month a year ago. Meanwhile, branded market share slipped from 44.23% in 2023 to 43.69% in the recently completed month.

During May 2024, unbranded stations in the U.S. garnered 56.09% of the market, compared with 55.58% during the same month a year ago. Meanwhile, branded market share slipped from 44.23% in 2023 to 43.69% in the recently completed month.

Although some of the big box retailers did see a bit of market share erosion, those, along with some of the grocery chains, remained some of the most efficient sites in the U.S., selling quite a bit of fuel considering much lower station counts than the brands and some of the large regional chains.

Buc-ees, Costco and Sams Club had the highest efficiency ratings, according to OPIS AnalyticsPro data, but in all three cases, efficiency was down nominally from a year ago H-E-B, Wal-Mart and BJ’s all saw efficiency gains, but even with efficiency figures north of 6, they are still about one-third that of Buc-ees. Kroger, Ingles, Frys and Fred Meyer rounded out the top 10 in efficiency in May.

Costco maintains its spot as the most aggressive when it comes to pricing, as the average Costco price was 32.9 cents below the local average, which is just over 2 cents more of a discount than last May. One of the bigger movers in average price discounts versus the local average was California-based Flyers. There are 23 brands in the OPIS database priced 25 cents below the local average, increasing the discount from last year by 18 cents.

Costco maintains its spot as the most aggressive when it comes to pricing, as the average Costco price was 32.9 cents below the local average, which is just over 2 cents more of a discount than last May. One of the bigger movers in average price discounts versus the local average was California-based Flyers. There are 23 brands in the OPIS database priced 25 cents below the local average, increasing the discount from last year by 18 cents.

With May 2024 priced several cents higher than May 2023, big box retailers and some chains used it as an opportunity to become more aggressive on street price.