Midwest Gasoline: New Specifications May Impact Pricing in Summer 2025

Stakeholders supplying gasoline for the 2025 summer driving season have encountered significant uncertainty in recent months over the Environmental Protection Agency’s potential handling of a seasonal prohibition on using 15% blends of ethanol.

Summer E15 Use

Since 2011, the agency has barred access to E15 (gasoline blended with 15% ethanol) during the period spanning June 1 to Sept. 15 throughout most parts of the country. Under the Clean Air Act (CAA), E15 is not eligible for the 1-lb. Reid Vapor Pressure (RVP) waiver offered to E10 (gasoline blended with 10% ethanol) during the summer ozone season.

While that provision has long been a bane for producers of ethanol, emergency measures in recent years have reduced their concerns by offering temporary relief from the summertime prohibition.

The CAA offers the agency a provisional emergency waiver to allow E15 use that can be issued in 20-day increments over that summer driving season so long as extreme and unusual factors are weighing on the national fuel supply.

Waivers have accordingly been issued throughout the past three summer driving seasons, as the EPA under former President Biden argued that relief was necessary due to the war in Ukraine and conflicts in the Middle East. It is not yet certain whether the provisional emergency E15 waivers will be issued for this summer.

Midwestern States Opt Out in Order to Put E10 And E15 on Equal Footing

In April 2022, the governors of Illinois, Iowa, Nebraska, Minnesota, Missouri, Ohio, South Dakota and Wisconsin petitioned the EPA to allow their states to opt out of the 1-lb. Reid Vapor Pressure (RVP) waiver offered to E10.

Opting out of that E10 waiver, in effect, meant that refiners would need to supply a lower RVP gasoline blendstock (CBOB or sub-octane) in those states, which could then be blended to create either E10 or E15 gasoline, both of which would then remain below the maximum RVP level. In effect, that lower-RVP gasoline blendstock would put E10 and E15 on the same footing, without the need for the provisional E15 waivers that have been issued for recent summers.

Where Do Things Stand Now?

After postponements in recent years, the agency said in a February rule that it would allow the E10 waiver opt-out scheme to start this summer, before Ohio and South Dakota subsequently requested and received a one-year extension on the carveout.

State-based petroleum interests have expressed concern in recent months over their ability to install the requisite infrastructure to comply with the opt-out by this spring, and that consternation ultimately convinced the governors of both Ohio and South Dakota to punt it to next summer.

Regional distributors have argued since the announcement of the opt-out that they could be harmed by the change, as they would need to offer a variety of RVP blends of gasoline to states in the region dependent on their decision to either participate or bow out of the scheme.

How Are Spot Markets Being Impacted?

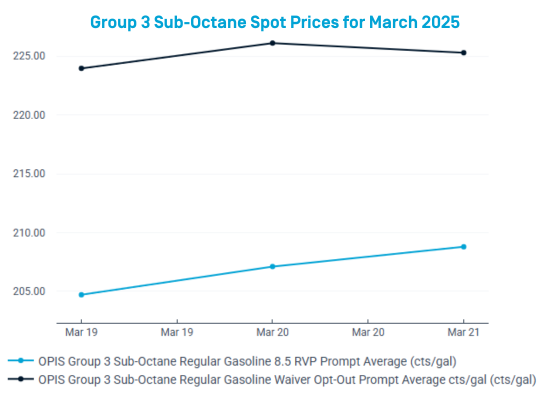

Because the spot market sees RVP shifts significantly earlier than at the retail level, those lower RVP grades have already begun to trade in the Midwest spot markets.

In the region, OPIS has begun assessing a “Waiver Opt-Out” RVP, representing the new lower RVP blendstocks trading there. Further downstream, OPIS Rack and Axxis software will show the specific RVPs, including prices under existing 7.8-lb. and 9.0-lb. headers where both products are available.

In the Group 3 spot market, for regular sub-octane and for premium gasoline, OPIS is showing Waiver Opt-Out RVPs (currently representing 7.3-lb. RVP specifications, which will then move to 7.8-lb. RVP specifications later in the spring). OPIS also continues to show an 8.5-lb. RVP (moving to 9.0-lb. RVP specifications later this spring).

In the Chicago spot markets, for CBOB and for premium gasoline, the RVPs vary by location. Currently, Waiver Opt-Out RVPs, representing 7.8-lb. RVP specifications, are being shown in Buckeye Complex, West Shore/Badger and Chicago Comprehensive markets, along with the typical 9.0-lb. RVP grades. In the Wolverine market, only 9.0-lb. RVP grades are being shown, because 7.8-lb. RVP grades are not expected to trade there this summer season.

At the spot market level, trade for the lower RVP gasoline in the Midwest has been relatively illiquid to start, with most activity centered on the West Shore/Badger pipeline system. However, the spread between the Waiver Opt-Out RVP supplies and the higher RVP material has been wide in Group 3.

As of March 20, 2025, Group 3 Waiver Opt-Out RVP sub-octane gasoline (V-grade) was priced close to 20cts above the 8.5-lb. RVP material. Further ahead, Waiver Opt-Out 7.3-lb. RVP supplies traded for April at a level that suggests a narrower spread between the 8.5-lb. and 7.3-lb. RVP material going forward.

As of March 20, 2025, Group 3 Waiver Opt-Out RVP sub-octane gasoline (V-grade) was priced close to 20cts above the 8.5-lb. RVP material. Further ahead, Waiver Opt-Out 7.3-lb. RVP supplies traded for April at a level that suggests a narrower spread between the 8.5-lb. and 7.3-lb. RVP material going forward.

However, in the Chicago markets, as of March 20, West Shore/Badger Opt-Out 7.8-lb. RVP CBOB was priced around 2.5cts stronger than the 9.0-lb. RVP barrels. In recent days, West Shore/Badger 7.8-lb. RVP CBOB traded at 12cts below April NYMEX RBOB futures, while the 9.0-lb. supplies were closer to 14.5cts beneath the screen. There has been, to this point, thin liquidity in Buckeye Complex.

In the previous two years, the American Fuel and Petroleum Manufacturers warned that low RVP gasoline blends may be prone to scarcity in the Midwest, with the region perhaps losing 131,000 b/d of local production that might require bringing in 39,000 b/d of motor fuel from other areas of the country.

Refinery analysts said the ability to make the new blends is “refinery-specific.” Some processors may struggle with removing butane and other light ends from gasoline streams while others might have few issues.

But there is no question that a 20ct/gal premium for the lower RVP grades rewards refiners who make it. There are no precise calculations on the cost increase but two refinery consultants put the likely cost differential on either side of 5cts.

Downstream Impacts

Refiners and other operators appear to be passing along the additional spring/summer costs at an uneven but brisk pace. The transition is leading to some dramatic differences between suppliers who are trying to recoup the higher replacement costs and others who have yet to act.

Wholesale racks are seeing some sharp differences between fuel prices, as some companies have introduced 7.8-lb. RVP sub-octane gasoline at the rack.

As of March 18 in Iowa, for example, there was a veritable smorgasbord of rack prices.

OPIS rack prices for 9.0-lb. RVP conventional E10 found some offerings around $2.08/gal, but those who have passed along summer gasoline costs were above $2.30/gal. OPIS had begun to report some E10 blends with a 7.8-lb. RVP priced just under $2.50/gal.

With the future of ethanol waivers and opt-outs from waivers still somewhat unknown, marketers don’t know which wholesale prices might ultimately reach the “fighting grade” status.

The consensus view among suppliers and distributors was that the new lower-RVP blends probably won’t lead to much additional blending for midlevel ethanol blends, thanks to costs and equipment concerns downstream. Additionally, if the eventual prices for lower RVP BOBs do work out to a 20ct/gal premium versus legacy fuel, the economics may not offer much of an incentive.

Consumers are beginning to see the impact of these RVP changes at the retail level as well, with some pump price increases of around 10cts/gal seen in Minnesota as of March 19.

Could E15 Waivers or National Legislation Alter the RVP Dynamics this Summer?

A series of E15 waivers, similar to those seen in recent years, could potentially be issued once again this year as the war in Ukraine and conflicts in the Middle East continue to impact global energy markets.

Market participants have been fairly bullish on the likelihood of E15 waivers after President Trump issued an executive order in late January directing the EPA to work with the Department of Energy and consider emergency waivers under the Clean Air Act “to allow the year-round sale of E15 gasoline to meet any projected temporary shortfalls in the supply of gasoline across the Nation.”

But the potential waivers, which are usually officially announced each year on April 27 or 28, appear less certain this year, given the dynamics in the Midwest.

Separately, there is the potential for a legislative fix to year-round, nationwide access to E15, but optimism for that has curtailed in recent weeks as the legislature dealt with the more pressing issue of funding the federal government.

And while a government shutdown was averted in mid-March, sources have told OPIS that it is unlikely the legislation, the Nationwide Consumer and Fuel Retailer Choice Act, will reach the president’s desk on an E15 deal before the end of April.

Tracking Prices for These New Lower RVP Specs

To keep you informed in this rapidly evolving marketplace, OPIS assesses Waiver Opt-Out spot pricing in its East of the Rockies Refined Spot Report (in Context PDF, online Context and Context API formats), as well as up-to-the-minute pricing through the OPIS Spot Ticker.

At the rack level, for Low RVP Rack Pricing in the “opt-out” states, OPIS will reflect two grades of fuel when both a 9.0-lb. and lower RVP product are available. The prices will be reflected in OPIS Wholesale Rack Reports as 9.0-lb. and 7.8-lb. during the summer months. Some suppliers have already added pricing for products they are referencing as 7.8-lb. However, most suppliers are still reflecting the product as a 9.0-lb. and are expected to switch over to posting at 7.8-lb. during the last few days of April.

UPDATE: On April 28, the EPA said that it will issue an emergency waiver on volatility limits for E15 during the summer driving season on May 1, with the waiver also extended to limits on E10 blends. The ONEOK pipeline, serving the Group 3 region, has also said that it is updated its origin specifications for sub-octane blendstock to reflect 9.0-lb. RVP.

In accordance with the resulting shift in trading, on May 5, OPIS discontinued Group 3 Sub-Octane Regular Waiver Opt-Out and Premium Gasoline Waiver Opt-Out gasoline spot prices. OPIS will continue to show the 9.0-lb. RVP assessments in Group 3 through the summer season.

OPIS will inform stakeholders of specific RVP transition dates for the Chicago markets, following observed market behavior, via subscriber notes at the top of the OPIS East of the Rockies Refined Spot Report and on the OPIS Spot Ticker.

To learn more about RVP and what OPIS is looking for this summer driving season, check out our free on-demand webinars: