Unlocking Carbon Tax Credits: 45Z & 45V

The Inflation Reduction Act (IRA) introduces two crucial tax credits—45Z and 45V—designed to accelerate the production of clean fuels and hydrogen. These credits can significantly lower producers’ costs while helping to meet sustainability goals. But to make the most of these opportunities, it’s important to grasp the key aspects and navigate the necessary steps.

In the OPIS webinar “Unlocking Carbon Tax Credits: 45Z and 45V” on April 30, Evelyn Loya, OPIS policy analyst, engaged in an in-depth discussion of these tax credits alongside congressional legislative staff, providing a comprehensive guide to 45Z (Clean Fuel Production Tax Credit) and 45V (Clean Hydrogen Production Tax Credit).

A more comprehensive overview of the 45Z and 45V tax credits is provided below as well as responses to some of the questions asked by attendees of the webinar that were unable to be answered during the session.

Overview

In recent years, public perception of clean fuels and clean hydrogen has evolved significantly as awareness of climate change and the urgency for sustainable energy solutions have intensified. The demand for affordable, low-carbon alternatives in transportation and other sectors has prompted both industry leaders and policymakers to explore innovative avenues to reduce carbon footprints. To catalyze this transition, the Inflation Reduction Act of 2022 (IRA), enacted under the Biden Administration, incorporates tax incentives aimed at fostering investment in clean fuels and hydrogen technologies. When implemented effectively, these incentives can significantly lower the costs associated with investments, stimulate research and technological advancements, and enhance the development of less mature fuel alternatives. As the world increasingly seeks viable solutions to environmental challenges, clean fuels and hydrogen emerge as promising pathways toward achieving a more sustainable future.

What is the IRA?

The IRA, signed into law in August 2022, represents a significant legislative initiative aimed at addressing several critical objectives. Primarily, the IRA seeks to reduce the federal deficit while providing tax credits, loans, grants to facilitate the decarbonization of the manufacturing and energy sectors. This initiative encompasses substantial investments and tax incentives across various domains, such as biofuels infrastructure, sustainable aviation fuel, carbon capture, energy efficiency, and rural electric systems. This discussion concentrates on two pivotal tax credits established by the IRA: the Clean Fuels Production Tax Credit (45Z) and the Clean Hydrogen Production Tax Credit (45V).

It’s important to note that the IRA was passed along party lines, with Democrats in both the Senate and House voting to pass it, while Republicans opposed the legislation. Recent actions by the Trump Administration aimed at limiting or potentially repealing certain incentives under the IRA underscore the contentious nature of this legislation. As such, the current year will be crucial in determining the future trajectory of these tax credits, especially as stakeholders across the political spectrum navigate the implications of this act for both economic growth and environmental sustainability.

Section 45Z: Clean Fuel Production Credit

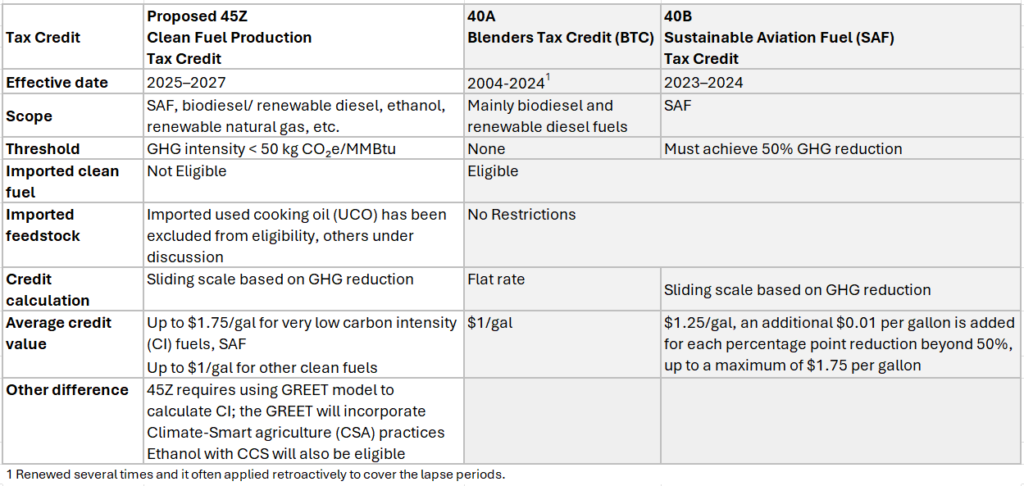

In early January, the Treasury Department and the Internal Revenue Service (IRS) announced a proposed rulemaking for the Clean Fuel Production Tax Credit (45Z). This credit is designed to bolster the production and sale of eligible transportation fuels, consolidating the former credits 40A and 40B, which expired at the end of 2024, into a unified credit that will phase out in 2027.

One of the most notable features of the proposed 45Z credit is its technology-neutral stance, which enables support for transportation fuels that generate zero or low greenhouse gas (GHG) emissions. This flexibility is crucial for fostering innovation across the industry. For a clearer understanding of the distinctions among the proposed 45Z and 40A and 40B credits, please refer to Table 1 below.

As the Treasury and IRS prepare to refine the proposed rule in response to public feedback, concerns linger regarding potential delays in implementation. The proposed 45Z credit is still in its nascent stages, and uncertainty surrounds its framework for various reasons. One pressing issue is the preliminary guidance regarding the eligibility of imported used cooking oil. Additionally, there are apprehensions about the investment horizon, as the credit is limited to taxable years 2025, 2026, and 2027. Moreover, there is ongoing debate about whether to implement a flat rate for the credit or to base it on the carbon intensity of the fuel.

According to OPIS forecasters, market reactions to the proposed rule were evident in January and February of 2025, with biodiesel and renewable diesel production witnessing a dramatic decline of 40-50%. Data from these months indicated a notable disparity in feedstock consumption; for instance, the consumption of lower carbon intensity feedstocks, such as soybean oil, decreased less significantly compared to higher carbon intensity options, such as canola oil.

Section 45V: Clean Hydrogen Production Credit

The regulatory framework surrounding tax credits includes Section 45V, with final guidelines issued by the U.S. Department of the Treasury in early January 2025. This tax credit is intended to promote the production of qualifying clean hydrogen, offering financial incentives of up to $3 per kilogram of hydrogen produced. The credit provides four tiers of incentive values based on the carbon intensity of the hydrogen production process. These credit values would reduce the cost of production close to $1 per kilogram.

The 45V credit value also depends on whether the project meets requirements pertaining to prevailing wage and apprenticeship. Emissions are measured up to the point of production using the 45VH2-GREET model. Section 45V is scheduled to expire in 2033, providing a substantial timeframe for strategic investments in this emerging sector.

The final guidance for 45V drew mixed responses from industry leaders and environmentalists. For instance, Frank Wolak, the President and CEO of the Fuel Cell and Hydrogen Energy Association stated that, “The administration made significant improvements and considered industry feedback in several instances when crafting this final rule compared to the initial proposal…However, this rule is still extremely complex and will require intense evaluation by project developers to understand all the nuances.”

Chief Executive Officer Jason Grumet of the American Clean Power Association said, “This is a disappointing conclusion to an unnecessarily belabored process. The overly rigid regulations are at odds with the innovation needed in this nascent sector and will prevent the U.S. from realizing global leadership in clean hydrogen production.”

Conrad Schneider, Senior Director at the U.S. Clean Air Task Force stated, “We hoped to see stricter guardrails around the use of existing clean electricity to make hydrogen…[we are] disappointed in Treasury’s decision to push hourly matching from 2028 to 2030, and we worry that this could cause at least some increase in emissions in the short term.”

While the prolonged rulemaking process for 45V resulted in deployment delays and market uncertainty, the final guidance will likely stimulate industry and bring enough hydrogen supply online to reduce technology costs.

The ongoing dialogue around the 45Z and 45V tax credits reflects the growing importance of clean fuels and sustainable energy solutions in the current economic landscape. As Congress navigates the budget reconciliation process, it is essential for stakeholders to stay informed and engaged.

Your Questions, Our Answers

Following are responses to questions raised during the webinar that were not addressed due to time constraints.

1. “Any indication on when the final guidance will become available for 45Z?” “For producers that are currently sitting idle, when can we expect some movement on the implementation of a tax credit?”

At this time, there has been no specified timeline for the release of the final guidance for 45Z.

2. “One concern some players have with the 45Z is the definition of the qualified sale that seems to limit multiple intermediate sale of the renewable fuels? Any insights into how this will be addressed?”

At this time, there are no specific insights from OPIS regarding the concerns related to the definition of qualified sales will be addressed in the final guidance of 45Z. OPIS continues to closely monitor developments in budget reconciliation, as potential legislation could significantly impact 45Z. However, it is important to note that there remains considerable uncertainty surrounding this tax credit.

3. “Is the Alternative Fuel Rebate going to be extended or does 45Z replace it?”

The Alternative Fuel Rebate will not be extended in its previous form. Instead, the proposed 45Z credit is intended to replace earlier fuel credits by focusing on technology and lifecycle GHG emissions. For a detailed comparison of the proposed 45Z credit with the expired 40A and 40B credits, please refer to Table 1 below.

4. “Is 45Z designed to be additive with RFS RINs?”

The proposed 45Z credit is not designed to be additive with the U.S. Renewable Fuel Standard (RFS) Renewable Identification Numbers (RINs); they operate as separate mechanisms. While a fuel that qualifies for the proposed 45Z credit may also be eligible for generating RINs, it is important to note that the proposed tax credit and RIN values are distinct incentives. The proposed 45Z credit is specifically intended to replace certain existing fuel credits that promote blending, focusing primarily on supporting producers of clean fuels rather than blenders.

5. “Can you elaborate on whether the Farmer First Fuel Incentives Act has any chance as a standalone bill or if it needs to be attached to other legislation, such as the budget reconciliation you mentioned?”

According to discussions on the Hill, it is very likely that aspects of the Farmer First Fuel Incentive Act will be included in the budget reconciliation bill. However, it is very unlikely that the legislation will be in its current form as legislators may make changes such as removing the domestic feedstock option and carbon scoring.