OPEC+ Production August Increase Covered by Current Production

On July 5, the eight members of OPEC+—the grouping of the Organization of the Petroleum Exporting Countries (OPEC) and ten other oil exporters—that agreed last December to an additional voluntary cut of 2.2 million barrels/day over a two-year period, announced the final stage of the unwinding of these cuts one year ahead of schedule by agreeing to a production increase of 548,000 b/d effective Aug. 1.

As with all OPEC+ production announcements, the increased production could be paused or reversed subject to evolving market conditions.

The announcement has once again focused the oil market’s attention on supply/demand dynamics with the view that supply will exceed demand resulting in downward pressure on oil prices over the balance of 2025 and 2026.

The July International Energy Agency (IEA) Oil Market Report provides support for this concern noting that it calculated global oil supply—OPEC+ and non-OPEC—to have increased by 950,000 b/d in June but global oil demand by just 720,000 b/d.

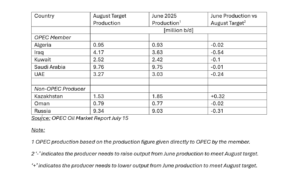

Production vs. Targets

Behind the headlines and instant reaction to the OPEC+ announcement of higher production from August, the reality may, however, be somewhat different if not more price supportive.

A look at the August production targets and latest production figures of the eight countries reveals some are already producing more than the target and others below it.

Based on the above data, should all eight producers meet the August target production, then a net 115,000 b/d extra oil would flow to the market compared with current June production.

Moreover, the total volume of additional oil from OPEC+ producers may be lower than the 115,000 b/d figure, as some of the above producers may not be able to raise production as much as shown in the above table. Russia, whose August target is 310,000 b/d above its June production, faces ever tighter international sanctions that could restrict outlets for its oil, regardless of any production target it has.

Other producers may equally struggle to place their extra production in the market given the lower appetite for crude amid rising clean energy supply to the power sector, one of the biggest consumers of oil and petroleum products, and weak demand for consumer goods and travel in the face of economic uncertainty.

The oil market is currently facing excess supply, but to see this as set in stone and that OPEC+ will not act to redress market balance could be misguided. OPEC+ has shown since its inception it is responsive to price signals from the crude market. It will act upon them and, if past trends are followed, rapidly if required.

Should oil prices, therefore, ease to a level OPEC+ members find do not support their budgetary requirements, it will act to cut production to support prices. Such a move could help tighten the market, as non-OPEC+ members may not have the spare capacity to cover the lower OPEC+ production. The resulting tightness may help prices improve.

–Reporting by Yazdi Merchant, ymerchant@opisnet.com; Editing by Rob Sheridan, rsheridan@opisnet.com