EU Chemical Plants Could Face €6.5 Billion Annual Carbon Bill by 2034

As the EU begins phasing out free carbon allowances under its Emissions Trading System (EU ETS), chemical producers across Europe are staring down a potential multibillion-euro carbon liability.

According to an analysis by OPIS of European Commission data, the 30 highest-emitting installations in the bulk chemicals, ammonia, and soda ash sectors received 26.6 million free EU carbon allowances (EUAs) in 2024, effectively shielding them from the majority of their emissions costs. However, with the EU’s plan to eliminate these free allowances by 2034, operators will need to either decarbonize or face substantial new compliance costs.

A Hidden Carbon Cost—For Now

In 2024, these 30 sites emitted 31.4 million metric tons (mt) of CO₂ equivalent but were granted 26,592,714 free EUAs. This gap between actual emissions and free allowances is a critical cost exposure, especially if EUAs prices increase as supply of allowances fall one year after the next.

The largest emitter, Dow’s Terneuzen plant in the Netherlands, emitted 3.31 million mt of CO₂e but received 2.43 million free allowances, leaving a deficit of 886,658 allowances. At current OPIS-assessed benchmark prices for December 2025 EUAs (€71.815), covering that shortfall would cost €63.7 million—assuming no hedging strategies are in place.

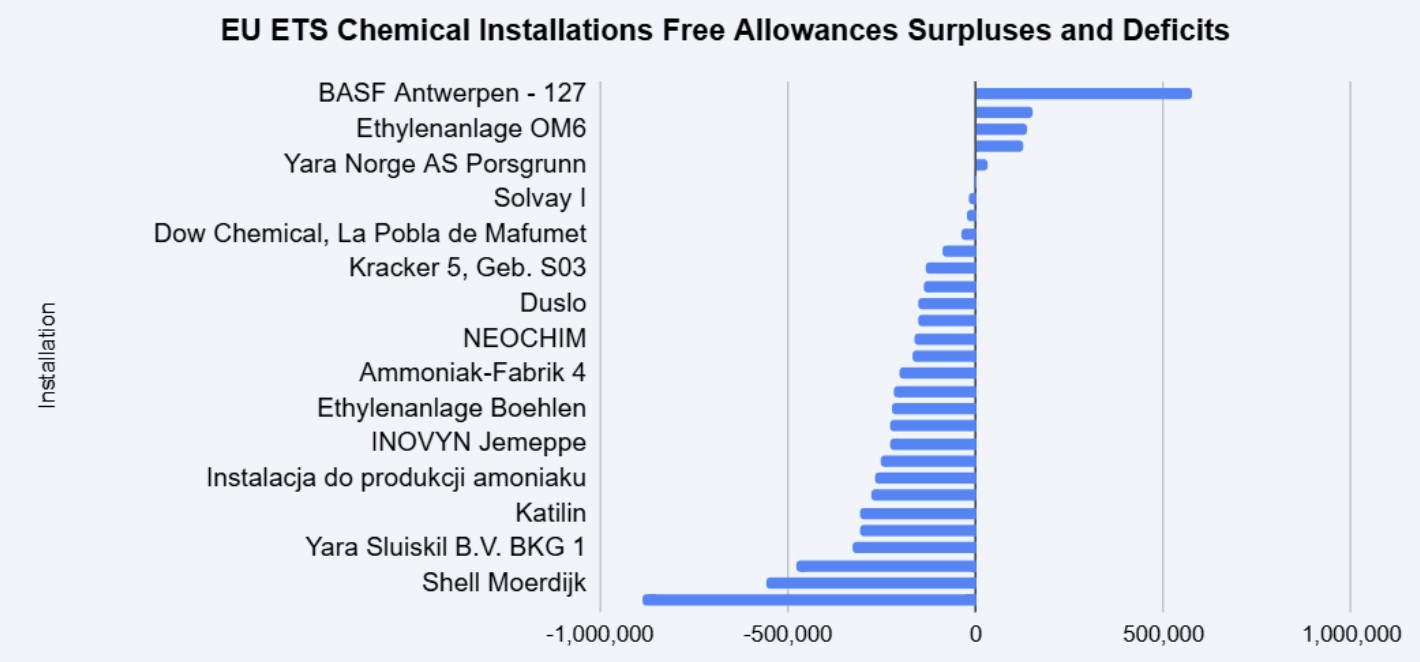

Interestingly, not all operators are in deficit. Five installations, including BASF’s Antwerp complex, actually received more allowances than they emitted. BASF’s surplus—575,530 EUAs—is currently worth €41.33 million and could be banked or sold on the market.

A System Designed for Protection—But Under Pressure

Roughly 40% of the EUAs allocated each year in the cap-and-trade system are distributed as free allowances, primarily to industries considered “hard-to-abate” such as chemicals and oil refining. The free allowance system aims to protect EU industries from being undercut by foreign competitors not subject to carbon pricing.

However, critics argue the system discourages meaningful decarbonization. To address these concerns, the EU is rolling out the Carbon Border Adjustment Mechanism (CBAM), which will place a carbon levy on imports starting in 2026. This levy will scale in parallel with the phase-out of free allowances over 2026-34, ensuring both domestic and foreign producers face a level playing field.

What Happens When the Safety Net Disappears?

If allowance prices follow OPIS price projections, the combined compliance bill for these 30 chemical plants would be €6.5 billion annually.

With utilities—who receive no free allowances—already active in EUA hedging, industrial operators in the chemicals sector may soon follow suit. As exposure to EUA prices increases, so will the incentives for operators to adopt both carbon risk management strategies and long-term decarbonization plans.